Residential Sales Stamp Duty

Stamp Duty Land Tax calculator

You can use the following calculator to work out how much you will have to budget.

The calculator works out the Stamp Duty Land Tax (SDLT) you'll have to pay for residential purchases (including lease premium) using new rules effective from 4 December 2014.

How does the Stamp Duty reform effect you?

In the Autumn 2014 statement, the Chancellor, George Osborne, announced the long-awaited changes to the Stamp Duty Land Tax, payable by buyers of UK property.

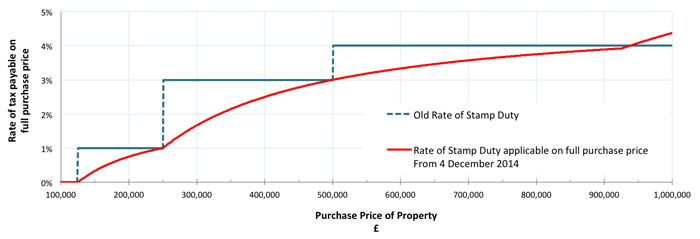

This long held cost to buyers has been criticised in the past as not adjusting with the increase in house prices, and was notably harsh to sellers their properties just above specific price points. The previous system distorted the market by making it very unattractive to buy a property for a price just above the stamp duty thresholds of £125,000, £250,000, £500,000, £1m, £2m because the entire value of the purchase was taxed at one rate.

Under the new system, which came into effect at midnight on 4 December, buyers of properties under £937,000 will pay less Stamp Duty than the old system. However, buyers paying over this amount may pay considerably more.

PLEASE NOTE: From 1 April 2016, Stamp Duty Land Tax will increase by 3% on top of current rates, for purchases of additional residential properties, such as buy to let properties and second homes.

| Purchase Price | Rate of tax payable |

|---|---|

| £0 - £125,000 | 0% |

| £125,001 - £250,000 | 2% |

| £250,001 - £925,000 | 5% |

| £925,001 - £1,500,000 | 10% |

| Over £1,500,000 | 12% |

The chart below compares the old rate to the new schedule applied to the full purchase price of the property, for purchases up to £1m.

From the chart, it can be seen that:

- No Stamp Duty is still payable for properties bought under £125,000

- For purchases over £125,000, the rate of tax payable gradually increases.

- There are now no discernable jumps in the tax rate, showing that the problem price points, i.e. £125,000, £250,000, £500,000 and others, now do not present any particular issues.

- For most purchases above £935,000, the Stamp Duty payable now is greater than under the previous regime.